November, 2020

Pros and Cons of employing - Inhouse vs Contractor (Financial)

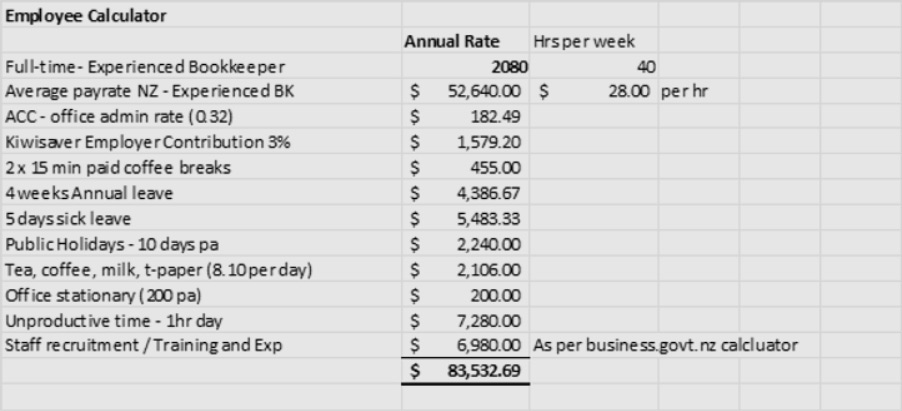

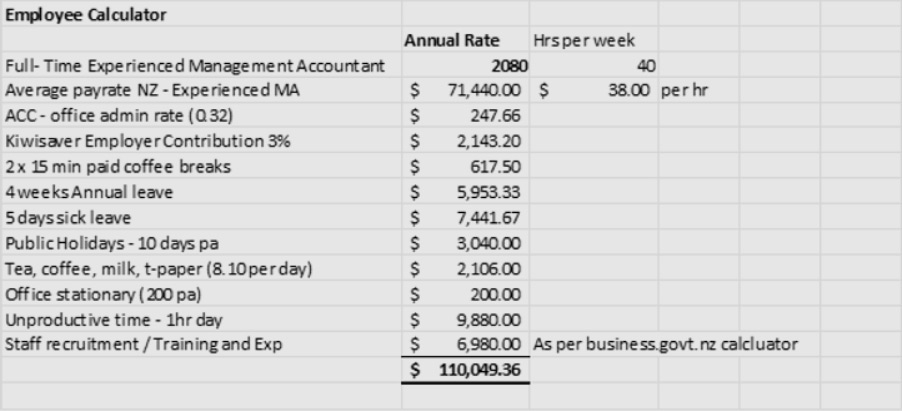

Lets start with the economic value.

Average costs of employing a bookkeeper inhouse $83,532.69 pa, for an employee paid $28 per hour.

Average costs of employing a Financial Manager inhouse $110,049.36 pa, for an employee paid $38 per hour.

Whilst $28 per hour is the average wage of an experienced Bookkeeper in NZ and $38 per hour for a Financial Manager (as per payscale.com) The employee has the right to review yearly and to keep a good employee and their intellectual property in your company you should expect pay rate and/or benefits to increase.

Average cost of employing a Bookkeeping / Financial Management Contractor

Small Business – Full package – $11,160 pa + GST

Medium Business – Full package – $14,880 pa + GST

Large Business – Full package – $17,760 pa + GST

Prices as per https://www.ourheadoffice.co.nz/copy-of-bookkeeping-pricing

How do we do this? There has to be a catch right!

No, its just that we have the systems and processes in place to maximise cost effective bookkeeping and reporting for our clients. Just like the product or service that you offer is your area of expertise, to a bookkeeping contractor this is their service so they need to be the best of the best.

Right so lets look at some of the other pros and cons, bear in mind what is a pro for one company may be a con for another, so you have to weigh up what is the best fit for you and your business.

- Larger pool of professional knowledge

When you outsource parts of your business, you’re accessing a pool of knowledge and expertise that you don’t have. They’ll have worked with other businesses like yours, providing support and advice to ensure they take the best course of action. Plus, they can translate any complicated jargon into simple English so that you’re always in the know. You are normally hiring a team not just one person so their skills pool is naturally higher. - Outsourcing helps reduce the risk of fraud

The most important practice to prevent fraud follows the standard accounting practice of separation of duties. No one employee should have control of all three primary functions, authorisation, record keeping and custody of assets. When you have just one or two employees handling your books, your company has a higher risk of fraud. The person paying the bills might be the one reconciling the bank account, and because there isn’t a separation of duties, you have just given them the keys to the bank. They can steal from you and cover their tracks. And you won’t find out until it’s too late. Contractors maintain a level of separation and more rigorous steps taken when providing financial statements for the business. Most outsourced companies have two sets of eyes reviewing each step with different levels of staff working on one account. There are steps taken for one employee to review the others work to ensure there aren’t any discrepancies or errors. - Face to Face

It can be nice to have someone in your office, answering phones, greeting clients and having the occasional lunchtime yarn. However it is a fine balancing act to find someone that is suited to this role and also has the expertise to reconcile your accounts, accurately complete your payroll and create financial management reports to ensure you are making sound business decisions backed by relevant financial data. In most cases it is wise to look at splitting these responsibilities between more than one person and can often turn out cheaper as your Financial Manager is going to expect to be paid more, even when they are being the personable face of your business. - Grow with the business

Having someone employed gives them the opportunity to grow within the business and helps the business develop higher trained staff specific to the companies needs. Don’t forget however that the contractor is a business owner like you and will also grow with your business. Also whilst this is your ideal you cannot be sure it is the ideal of your employee, their main objective is to do what is best for their life, and this may not be in your business. A contractor however is a business owner and the bigger you grow the bigger they grow, it is in their best interest to align with you so both your business and their business can grow.